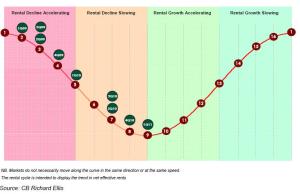

My research department recently released their Miami rent cycle graph which shows we are at the bottom of the rent cycle. CBRE tracks rent cycles on a global basis and Miami is one of the US cities we track.

As you can see, it is clearly evident that Miami is at the bottom of the market in office rental rates. The pendulum is about to swing to the landlord’s advantage.

To put Miami into perspective on a national basis, Chicago, San Diego, Los Angeles, Austin, Atlanta and Houston have not reached the bottom where we sit. While New York, northern New Jersey, San Francisco, and Boston are a step ahead of us.

This rent cycle chart is subjective rather than a verifiable calculation or “fact”. It is intended to represent, in a general sense, where the Miami office market stands. This rent cycle is based on information gathered by the CBRE research team who surveys the office brokers within the Miami CBRE office and actual deal information collected by our research department .

This chart looks at effective rents (i.e. what the tenant actually pays, after taking into account leasing incentives, etc.) rather than “headline/quoting/asking” rents.

Keep in mind that markets can move in either direction along the curve, and may “jump” from one quadrant to another depending on changes in market conditions. They need not progress along the curve smoothly. You can see that happening between the 1st quarter of 2010 and the 2nd quarter.

This chart is intended to be a snapshot of the current position/most recent change in rents (updated on a quarterly basis), and the following points should be noted:

- the chart reflects overall trends rather than each micro-movement in rents

- there is inherently a forward looking element to the positioning of markets on the cycle, involving brokers’ judgments on the anticipated strength and direction of future rental change

- this chart is based on the question: “how did rents move over the last 3-6 months, and how does this compare with expectations for the next 3-6 months”

This rent cycle looks at Miami as a whole, so we in reality must take into account the nuances of individual submarkets. One thing is clear — the window of opportunity is closing. Call me today to discuss creative ideas on how to take last minute advantage of the rent cycle before it’s too late.